Starting down the road of looking at skilled nursing facilities and nursing homes can be overwhelming. Whether you are looking for yourself or a loved one, there can be a lot of factors to consider.

The main consideration for most people is cost. According to New York state data, the average annual cost of a nursing home is approximately $146,000-173,000, depending on which area of the state a person lives. In the Rochester region, the daily cost is approximately $474; the cost is about $401 per day for those living in the St. Lawrence region.

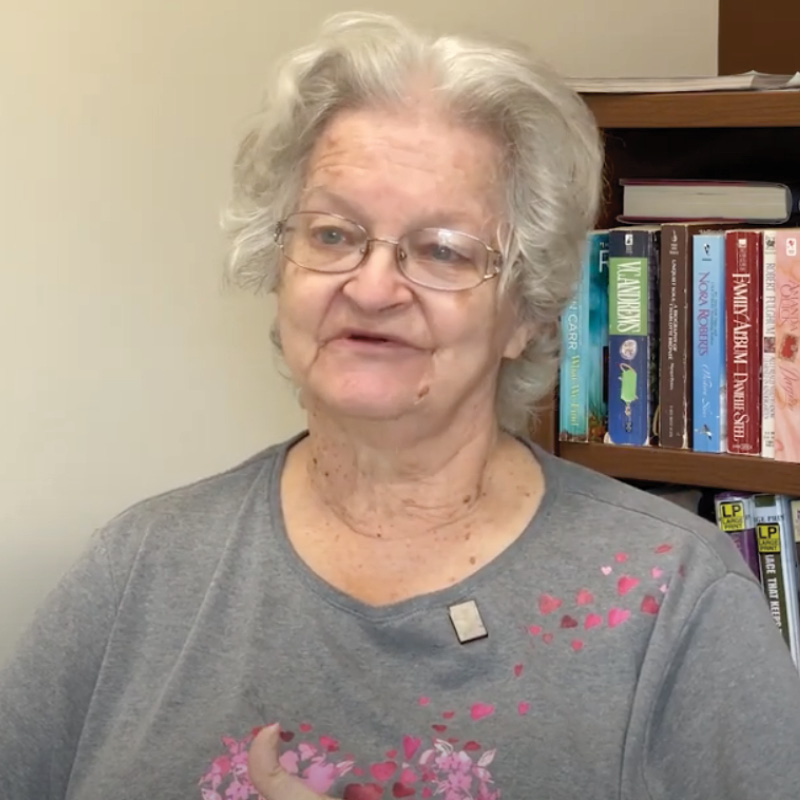

To help with the process, we asked Tiffany Reger, Manager of Admissions and Business Development for Long Term Care with Rochester Regional Health, what people need to know about finances and nursing homes as they begin their journey.

What qualifies a person for a nursing home?

Nursing homes are designed for older adults who require ongoing medical attention and assistance with most or all activities of daily living (ADLs), such as bathing and getting in and out of bed. Of all the various non-home living choices, nursing homes requires the highest level of care from healthcare professionals.

A nursing home may be a good option if you or someone you care for:

- cannot care for themselves at home

- complex medical needs that cannot be managed at home

- has a chronic disease

- needs help with taking medication

- significant physical or cognitive decline

“It is important to know that nursing homes need to prioritize patients coming from a hospital setting because their medical needs are often complex and require a great deal of care,” Reger said.

Where to start with finances for nursing homes

If a nursing home or skilled nursing facility is the right fit for you or your loved, your first phone call should be to meet with an elder law attorney.

Elder law attorneys specialize in many areas of late-in-life care, including helping people organize their financial assets so they can use them to their fullest extent. This includes Social Security, Medicare, Medicaid, and veterans’ benefits, along with bank accounts, trusts, investments, real estate, and any other funds that could be used to pay for nursing home care.

“People want to get the placement that they need, but maybe have some of their assets protected,” Reger said. “There may be different types of trusts they can put money in but still have enough cushion to get themselves into a skilled nursing facility. Elder law attorneys can help with that.”

To get in touch with an elder law attorney, Lifespan, ElderONE, GRAPE (Greater Rochester Area Partnership for the Elderly), and the St. Lawrence Office For the Aging are all excellent resources within the Rochester and northern New York regions.

What to bring to the first meeting

The first meeting with nursing home staff is typically with a financial admissions counselor. If you met with an elder law attorney before your meeting with a skilled nursing admissions counselor, you should know the value of all financial assets available to you or your loved one.

Eligible nursing home residents will be asked to fill out a skilled nursing referral form that asks about financial resources including:

- monthly income

- assets

- life insurance policies

- real estate

- financial interest in business(es)

At the meeting, the admissions counselor will look at a person’s listed assets to determine if they qualify to become a resident. Each skilled nursing facility varies in cost depending on whether the facility accepts Medicaid, what amenities are offered, and other factors.

Some residents pay using their assets (private pay), some start using assets and transition into Medicaid, while others are fully on Medicaid.

Next steps for choosing a nursing home

With dozens of nursing homes in the Rochester and St. Lawrence regions, starting to look at which one might be the best fit can be daunting.

After meeting with a financial admissions counselor, there are several next steps you can take to learn more about what is the right fit for nursing home care.

Talk with a case manager: Case managers specialize in helping people get organized and connected to the resources they need to transition into a nursing home. They are certified to conduct a patient review instrument (PRI) to determine if you are eligible for skilled nursing facility care. Case managers can also conduct the New York state-mandated screening required for skilled nursing facilities.

Set up a tour: Ask the nursing home admissions teams about touring a facility. This gives you the opportunity to see not only where you or your loved one might be staying, but also how long it takes to travel there, how other residents live, activities that are available, and many other things that can only be done in person.

Fill out applications early: Start as early as you can so you know what you need and how far in advance you might need to do it. There are wait lists at nursing homes and skilled nursing facilities, so being prepared and not waiting until the last minute can take a lot of stress off of you and your family.

“Nobody likes to talk about the end stages of life because it might feel scary or embarrassing,” Reger said. “The reality is, most people are going to need a place to go at some point, and it's better to know what you're doing and what you need to have prepared ahead of time.”